Governance Quotient: A Practical Check on Risk, Control and Decision-Making

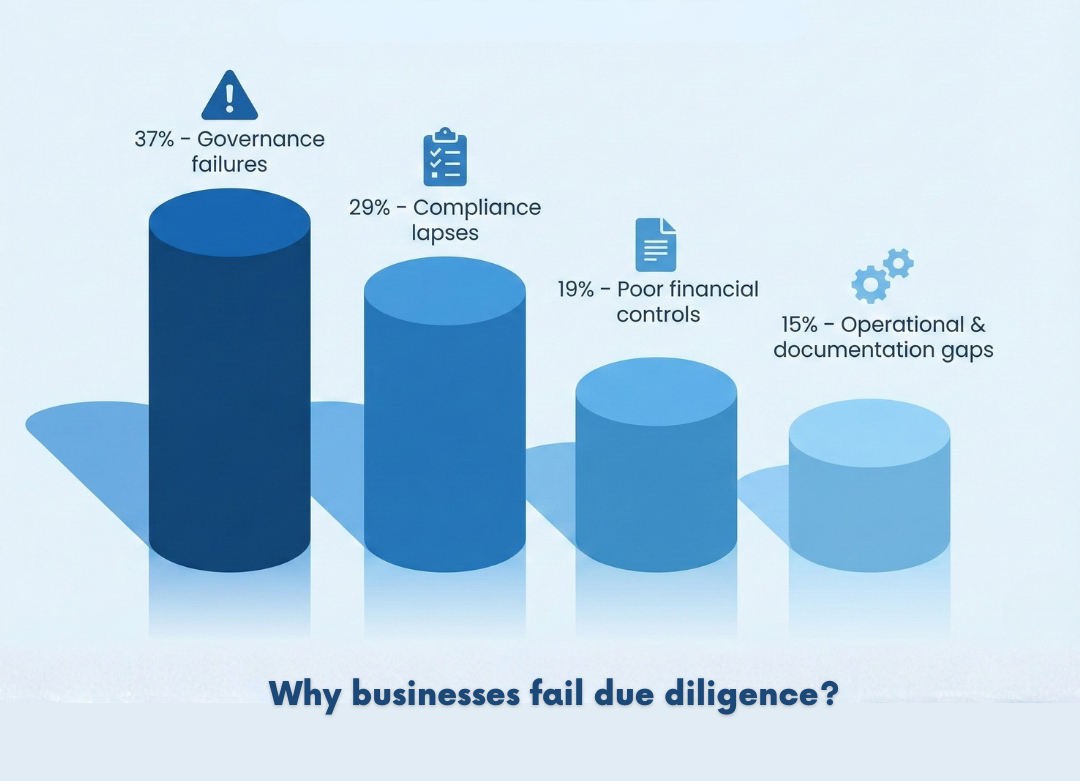

More than one in three companies fail due diligence due to weak governance. Our GQ framework will help you show exactly where you stand and what needs to be done, for a stronger and more accountable business.

What Is Governance Quotient?

Governance Quotient (GQ) is a health score of your business that gives you a clear data-backed measure of how well your business is structured and controlled. It helps in bringing together the elements that operate in silos into a single easy-to-understand indicator. These includes factors like leadership discipline, compliance behaviour, financial controls, operational processes and ethics.

In a world that is moving faster along with the changing regulations, GQ helps you answer one essential question:

"Are we truly governance-ready, or are you unknowingly carrying risks?"

For any business, no matter how big or small - having a right answer to the above question shows where the business is standing right now.

Investors see reliability in your business, banks see stability, employees see clarity and leadership seek the comfort of operating with fewer blind spots. Having the right GQ number will save your business from long-term risks.

Components that shapes your Governance Quotient

Leadership & Decision-making Discipline

How structured your board and leadership processes are - and whether decisions are recorded, justified and compliant.

Compliance Hygiene & Regulatory Readiness

Your consistency in maintaining statutory filings, registers, documentation and legal obligations.

Financial Governance Strength

Accuracy, transparency, controls and reliability of your accounting and financial reporting systems.

Internal Controls & Operational Systems

Whether your business runs on documented processes or people-dependent habits - and how well risks are managed internally.

Ethical Governance & Organisational Conduct

The standards that shape behaviour, conflict management, responsibility and overall accountability.

Why Governance Matters More Than Ever

Over the last few decades we have seen that the regulatory space has evolved a lot. Now governance is not just a "good practice" to have, but a strategic necessity. As Companies Act has made the rules tighter, SEBI and MCA are more vigilant, the lenders and the investors have become stricter as they look at governance maturity even before financial performance.

The majority of the business think they are safe, until something exposes the gap they were ignoring.

Wherever may your business be located in tier 1, 2 cities or even any other place in India. Companies now operates in a high-speed environment where:

- Now regulatory scrutiny has now increased 45% than in the last 3 years.

- Board governance failure becomes the top cause of due diligence rejection.

- Banks under RBI gives importance to governance strength

- Global clients and investors demanding ESG-aligned as a baseline

This is where many organizations fail to align, they solely rely on compliance events (filings, audits, renewals) instead of governance systems. And that's exactly where our team at MSA steps in for your business.

At MSA we have seen even well-run businesses, family owned enterprises, venture-funded startups, healthcare institutions, etc., carries unrecognized governance weaknesses.

On the other hand with a strong governance foundation, the opposite happens:

- Investors trust you more

- Lenders gives fast-track approvals

- Teams operate with clarity

- Leadership makes decisions with confidence

- Compliance stops being a headache and becomes a habit

These are the reasons why governance has more importance than ever. Today it is not just about safety but also about staying competitive, credible and ready for scale.

What We Measure

From early stage startups looking for their first funding cheque to a listed company that is preparing for global capital - Governance Quotient (GQ) stands as the key.

Global agencies like ISS usually assess your company's metrics across Audit & Risk, Board Structure, Compensation and Shareholder Rights. And these factors are strengthened by frameworks like SEBI, the Companies Act 2013, the Kotak Committee recommendation etc.

At MSA, we measure your Governance Quotient across the areas that matter most to Indian businesses:

Accountability & Leadership Integrity

In an organisation the quality of your leadership determines the quality of governance. Good leadership always strengthens your GQ score by 25-30%.

We try to assess the following things:

- Whether your board is empowered, not symbolic

- Decision-making discipline and documentation

- Independence and effectiveness of committees

- Whether governance is led from the top

Transparency & Reliability of Information

When you have a clear disclosure of everything in your organisation. Then it acts as the backbone of your investor trust and minority shareholder protection.

- Accuracy of financial reporting

- Communication quality with shareholders & stakeholders

- Red-flag indicators like misreporting or related-party transactions

Internal Controls, Risk Management & Processes

See whether your organisation runs on systems or on improvisation.

- SOPs for operations

- Segregation of duties

- Risk registers & mitigation plans

- IT & data governance systems

The G20 Startup20 charter emphasises institutionalising processes early, not waiting until IPO stage.

Investor Confidence & Growth Readiness

Your GQ reflects how "investor-ready" your business is today.

We evaluate readiness for:

- Funding

- Bank credit

- Strategic partnerships

- Due diligence

- IPO preparation

Who Should Get a Governance Quotient Assessment?

A GQ assessment is not just for companies that are in trouble. But now it is for organisations that want to grow by tackling all the blind spots on time. Whether you are trying to scale fast or trying to raise capital, you GQ tell you exactly how prepared you are.

If any of these sound like you, then your business needs a Governance Quotient assessment right now:

- You have a startup looking for Seed, Series A, Series B or any other sort of funding.

- Have venture-funded companies heading into due diligence cycles.

- You are operating without a structured board governance.

- SMEs building internal controls, SOPs, or compliance hygiene.

- You are planning for a bank credit, external borrowing or rating upgrades.

- Your organisation is facing recurring compliance penalties or MCA/SEBI notices.

- You are trying to expand to multiple locations or geographies.

- You are preparing for IPO, valuation benchmarking, or investor audits

- Enterprises implementing ESG

- Organisations upgrading MIS reporting, internal audit, or risk management systems

Why Choose MSA for Governance Assessment

Governance is not just a tick box for your business. Instead it is about building a business that can stand the test of scrutiny, scale, and speed.

And that's exactly where our expert team here at MSA helps your business. With over a decade of experience across compliance, taxation, advisory, and internal controls, our team understands how Indian businesses actually operate. We blend global governance models with India's regulatory realities to give you a Governance Quotient (GQ) that is practical, actionable, and future-proof.

Here's what sets MSA apart:

- CA-led governance expertise backed by real regulatory insight

- Deep experience across startups, MSMEs, family enterprises & corporates

- A structured ISS-inspired scoring approach adapted for Indian frameworks

- Practical, implementable recommendations, not theoretical checklists

- End-to-end support: from assessment to correction to monitoring

- Strict confidentiality and ethical handling of all business information

- Clear governance roadmaps that leadership teams can actually use

Our goal is simple: "give your business the governance strength it needs to grow without getting unexpected surprises."

Common Governance Mistakes Businesses Must Avoid

Even well-run organisations make governance mistakes. And these are not out of negligence, but because modern business environments move faster than internal systems.

Below we have compiled a table that highlights the most frequent governance errors companies unknowingly make. Try to avoid those mistakes:

| Mistake | Why It's a Risk |

|---|---|

| No structured board | This could lead to poor oversight, weak accountability, and red flags during due diligence. |

| Missing or outdated statutory registers | This is one of the most common reasons why you could get compliance penalties and DD failures. |

| Weak internal controls & no SOP-driven processes | Chances of increased fraud risks, financial leakages, and operational inconsistencies. |

| Poor MIS reporting or unreliable financial dashboards | Causes valuation disputes, investor mistrust, and management blind spots. |

| Ignoring related-party transaction documentation | This triggers governance concerns and regulatory scrutiny under Companies Act & SEBI norms. |

| Delayed audits or selective disclosure of financial data | This could lead to credibility issues with your investors, lenders, and potential partners. |

| No risk management framework or IT/data governance | This could make your business vulnerable to cyber risks, internal fraud, and process breakdowns. |

Let us help you with your governance today for a sustainable growth tomorrow

Having a strong governance is not just about meeting regulations. But it is about building a business that can scale with confidence, attract the right investors, and operate without hidden risks.

Your Governance Quotient (GQ) gives you that clarity. At MSA, we help you see where your organisation stands today and guide you toward the systems, discipline, and transparency needed for tomorrow.

When governance becomes a habit, growth becomes a natural outcome, and that is the future we help you build.

Let MSA help you build a business that investors trust and teams rely on.

Request a FREE GQ Assessment

Submit the details to receive FREE governance assessment. Please enter all the fields.